What You Need to Know About Life Insurance

Types of life insurance: There are several different types of life insurance, but just two broad categories you really need to understand: term life and permanent life.

What is term life insurance?

Term life insurance is the most simple and affordable option. It provides coverage for a set period of time or “term” (typically 10–30 years), and is designed to protect your dependents during that term. If you pass away during the term period, your beneficiaries receive a cash payment referred to as the “death benefit” to cover expenses or income loss related to your passing.Think of term life insurance like a subscription. For example, John, a healthy 35-year old buys a 15-year term policy with $1 million in coverage to provide financial protection for his family until they have enough retirement saved. He pays a $47 monthly premium to keep the policy in place over the 15-year term (similar to a subscription). If he were to pass away during the term, his beneficiary (typically a spouse or child) would receive the entirety of his coverage ($1 million in this example), tax-free. If John passes away after the 15 year term, a death benefit would not be paid; instead his family would rely on the retirement savings accumulated during the time John’s income was protected by insurance.

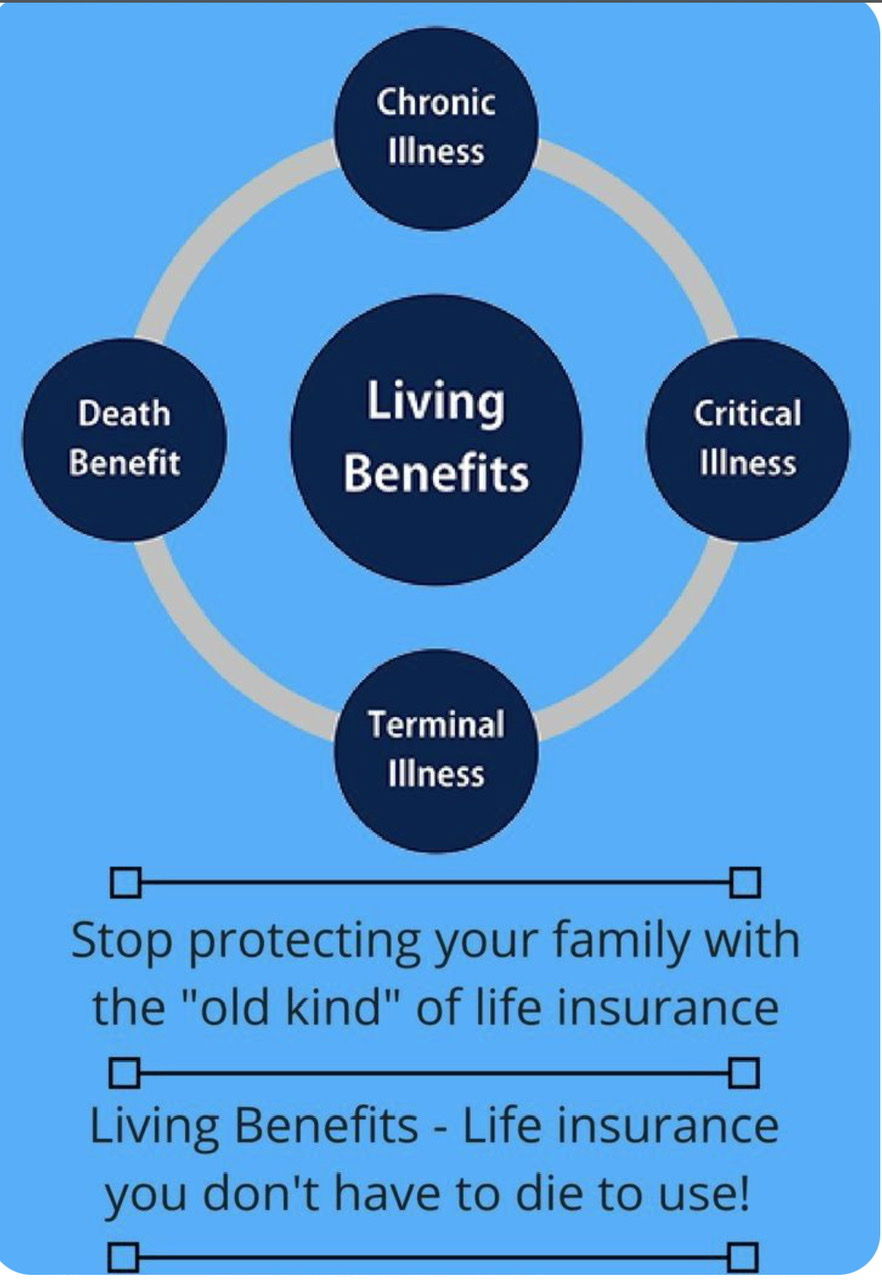

What is permanent life insurance?

Permanent insurance is more complex than term, and it offers different benefits. Whole life is the most well-known and simplest form of permanent life insurance. While term life insurance lasts for a specified term, whole life insurance lasts for the rest of your life. A payout is guaranteed at the time of death for your policy’s beneficiaries, and some of the money paid into the policy (your premium) is set aside to build “cash value” which can increase the death benefit or be accessed on a tax-free basis with a policy loan. Advocates for whole life policies say this is a more conservative, long-term strategy over buying term insurance. These features are why whole life policies can cost up to 5-10X more than term policies.

What type of insurance is best for me? When choosing between term and whole life, consider how long you want coverage, the purpose of the coverage, and how much you want to pay.

Some financial planning experts argue that purchasing whole life insurance isn't worth the cost. That's because of the higher premiums and low return on the cash value component. It’s possible to accumulate more wealth while you are alive if you invest the cost savings from buying a term policy vs. a permanent policy in the stock market or even traditional means, such as a 401(k) account, IRAs, and bonds. However, whole life insurance policies are useful for some people who need lifelong coverage and want the safety and guarantees the product provide. It also can be used as an effective way of estate planning for those with high incomes who have already maxed out their other tax-deferred accounts. Whole Life insurance can be added to your will as a way to pass on a legacy to your heirs.

Term life insurance policies may be a good option and a better financial choice for many families. Particularly if:

- You need to replace your income over a specified period of time (for example raising children or paying off a mortgage).

- You want the most affordable coverage.

- You want a more streamlined and straightforward process.