We are in the business of helping people find the right coverage for their needs. We are contracted with multiple insurance carriers so you choose the plan that’s right for you

Insurance Companies Represented

About us

BEHIND THE SCENES

Our Mission and Core Values:

- We are dedicated to doing the right thing and being honest in all we do.

- We strive to serve our clients with compassion and humility. We work hard to listen first and speak later so that we earn the trust of the clients that we serve.

- We service and respond to the needs of others in a timely manner to help them find coverage suitable to their individual needs

Meet Crystal Royster, Registered Nurse & Independent Licensed Insurance Agent:

Crystal Royster has been a registered nurse for over 27 years. For the past 20 years, Crystal has been providing care coordination for members of various insurance companies so they can get the care that they need. As of November 2020, she has transitioned from nursing to Insurance services with a focus on Medicare coverage options, Life Insurance and Annuities. Crystal helps people choose insurance plans that fit their needs and give them access to the quality care that they deserve.

As a Licensed Insurance Advisor, Crystal helps you review and evaluate Medicare and other insurance plans and their benefits. She also educates and guides you in choosing a suitable Insurance plan that fits your needs. The advantage of Crystal representing different insurance companies, is that you get to choose from a wider variety of plans when working with her and since she’s not bound to just one insurance company, Crystal can usually provide you with objective recommendations for Medicare and other insurance coverage.

Given Crystal’s nursing background and experience working with several insurance companies over the past 20 years, she has the knowledge, compassion and insight to help clients obtain the insurance coverage that they need. Whether you need a Medicare Advantage plan, Critical Illness Plan, an Annuity or Life insurance, Crystal has you covered! She will help you find the coverage that fits your needs as she is well-versed in insurance matters and will work in your best interest.

If You Are Ready to Enroll In A Medicare Plan After Speaking With Us, Click Here

Services

Medicare Services

Royster Insurance Options offers comprehensive Medicare services to help you understand and choose the right coverage for your healthcare needs. Our experienced team will guide you through the complex process and ensure you have the right plan for your health and lifestyle. Contact us today to explore your Medicare options.

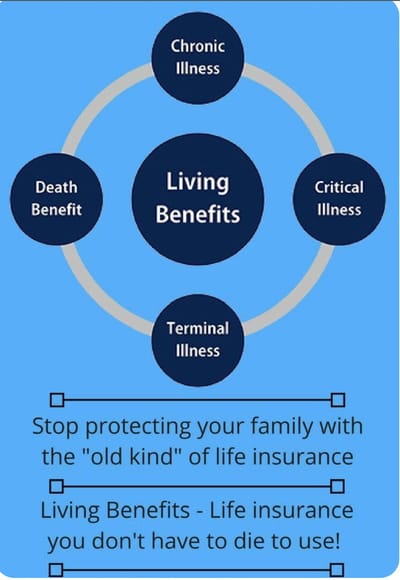

Life Insurance Services

Protect your loved ones and secure their financial future with Royster Insurance Options' life insurance services. Our tailored plans provide peace of mind and financial security for your family in the event of unforeseen circumstances. Let our team assist you in planning for tomorrow, today. Contact us to discuss your life insurance needs.

Insurance Consultations

Seeking expert advice on insurance options? Royster Insurance Options provides professional consultations to help individuals make informed decisions about their insurance coverage. Whether it's Medicare or life insurance, our consultations offer personalized guidance based on individual needs and preferences.

Life Insurance Solutions

At Royster Insurance Options, we specialize in offering personalized life insurance solutions to provide financial security and peace of mind for our clients and their loved ones. Our expertise in the life insurance market ensures that we can guide individuals towards the most suitable policies for their specific needs.

Medicare Insurance Services

Royster Insurance Options provides comprehensive Medicare insurance services designed to meet the needs of individuals seeking healthcare coverage. Our team of experienced agents is committed to helping clients navigate the complexities of Medicare and find the best coverage options available.

F.A.Q.

Need to know

A fixed indexed annuity (FIA) may help you map out a sound income plan for the years ahead. Learn more by contacting us at 336-255-0633

Read MoreFinal Expense insurance is a form of permanent insurance that covers a wide range of expenses you leave behind. They can include your funeral, legal fees, medical bills, and more.

Read MoreDiscover the different types of life insurance policies available and how they can provide financial protection for you and your loved ones.

Read MoreIf you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

Read MoreDiscover how hospital indemnity plans can complement your existing health insurance and provide additional support for out-of-pocket expenses.

Read MoreContact us

- 1451 South Elm-Eugene Street, Greensboro, NC, USA

- Suite 2012

- +1-3368928947

- crystal@roysterinsuranceoptions.com

- Tuesday through Thursday 10am - 5pm *Closed on Friday, Weekends, Monday & Holidays* *Office closure Jan 30-Feb 9*

Contact us for a quote or to set up a time to discuss your insurance needs. By providing your information above, you are granting permission for a licensed insurance agent to contact you regarding your Medicare options, life insurance or annuities